Table of Contents

Introduction to Green Bonds

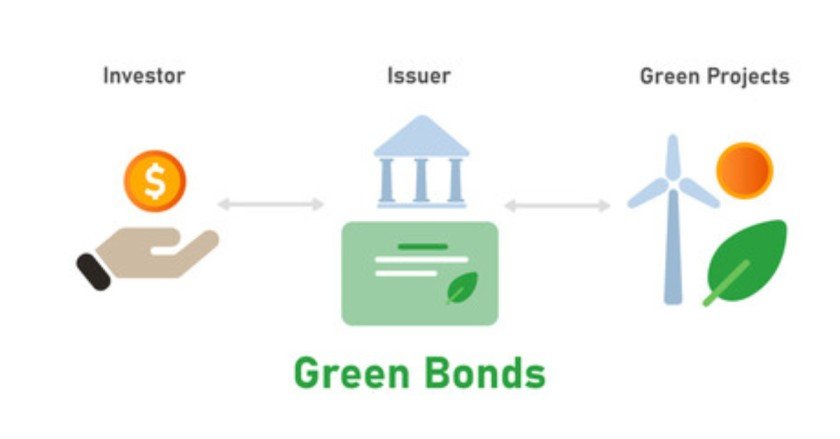

Investing in green bonds is a crucial and impactful step towards building a more sustainable and eco-friendly future for generations to come. Green bonds, essentially, are fixed-income securities designed to raise capital for projects with environmental benefits. These projects can range from renewable energy and energy efficiency to sustainable water and waste management initiatives.

For individual investors looking to align their portfolios with environmentally conscious initiatives, understanding and integrating green bonds can be a significant opportunity. By incorporating green bonds into their investment strategy, individuals can help accelerate the transition to a low-carbon and sustainable economy while also diversifying their investment portfolio.

This comprehensive guide delves into the specifics of green bonds, providing insights into their structure, impact, and potential returns. By gaining a thorough understanding of green bonds, investors can make informed decisions that not only yield financial benefits but also contribute positively to the preservation of our environment.

Content Strategy with SEO Considerations:

What Are Green Bonds and Why They Matter

Green bonds, a specialized type of fixed-income instrument, have been gaining significant traction in the financial sector as an innovative tool to raise funds for projects with positive environmental impacts. These bonds play a crucial role in addressing climate change, promoting sustainability, and fostering a greener future. As the world grapples with pressing environmental challenges, the significance and relevance of green bonds in financing a wide array of eco-friendly initiatives continues to grow, reflecting a promising shift towards more environmentally conscious investment strategies.

Green bonds are particularly attractive to investors seeking to align their investment portfolios with their environmental values. By providing a direct link between investment capital and environmentally beneficial projects, green bonds offer a tangible way for investors to contribute to the transition to a low-carbon, sustainable economy.

Furthermore, the growth of green bonds has spurred innovation in the financial markets, leading to the development of new financial products and services designed to support sustainable and environmentally friendly initiatives. This demonstrates the potential for green bonds to not only drive positive environmental change but also to stimulate economic growth and innovation in the financial sector.

In conclusion, the rise of green bonds represents a significant step towards achieving environmental sustainability and addressing the urgent global need for climate action. As the demand for sustainable investment opportunities continues to rise, green bonds are poised to play an increasingly vital role in shaping the future of environmentally conscious finance. b

The Growth of Green Bonds in the Global Market

The market for green bonds, which are specifically designated to fund environmentally friendly projects, has seen exponential growth in recent years. This growth signals the financial sector’s increasing commitment to supporting sustainable initiatives such as renewable energy, clean transportation, and energy-efficient buildings. In our analysis, we will examine this remarkable growth trajectory, taking into account the rising demand for green bonds driven by the urgent global focus on environmental sustainability. As investors seek to align their portfolios with environmentally conscious investments, understanding the implications of this growth becomes increasingly important.

Step-by-Step Guide to Investing in Green Bonds

Interested in making a positive impact with your investments? Our comprehensive step-by-step guide offers actionable advice and valuable insights for getting started with green bonds, an eco-friendly investment that supports environmental initiatives while delivering potential financial returns. To successfully incorporate green bonds into your investment portfolio, follow these steps:

1. Understanding Your Investment Goals

Before diving into green bond investments, it is essential to determine your investment goals and objectives. Consider your risk tolerance, desired returns, and overall financial strategy. This step will help you choose the right green bonds that align with your values and financial needs.

2. Researching Green Bond Offerings

The next step is to research the different types of green bonds available in the market. It is crucial to understand their unique characteristics, such as the issuer’s credit rating, maturity date, and use of proceeds. This research will enable you to identify the most suitable green bond offerings for your investment goals.

3 Evaluating the Impact and Returns

Green bonds not only generate financial returns but also support projects with positive environmental impacts. As an investor, it is essential to evaluate the potential impact of your investments and ensure they align with your values and goals. Additionally, consider assessing the potential financial returns of your green bond investments.

4 Diversification and Risk Management

*As with any investment, diversification is key to managing risk. Consider including a mix of different types of green bonds in your portfolio, including those issued by governments, corporations, and international organizations. Diversification can help mitigate risk while providing exposure to a range of sustainable initiatives.

Assessing Risk and Return in Green Bond Investments

Apart from the environmental impact, it is crucial to consider the potential risks associated with green bond investments. As with any investment, green bonds also carry a certain level of risk, including credit risk, liquidity risk, and interest rate risk. It is essential to carefully evaluate these risks and make informed decisions based on your investment goals and risk tolerance.

The Future of Green Bonds and Sustainability

The increasing popularity of green bonds signifies the growing demand for sustainable investments. As more investors seek to make a positive impact through their investments, the green bond market is expected to continue its upward trend. In addition, governments and international organizations are also playing a crucial role in promoting sustainable finance by issuing more green bonds. As the focus on environmental sustainability intensifies globally, green bonds will play a critical role in financing eco-friendly initiatives and shaping a more sustainable future for generations to come.

Let’s take a step towards a greener future by incorporating green bonds into our investment portfolios. By investing in environmentally friendly projects, we can make a positive impact while also generating potential financial returns. Start your journey towards sustainable investing today!

The Role of Government Policies in Green Bond Markets

Government policies play a significant role in shaping the green bond market, impacting investment decisions in sustainable finance and environmental stewardship. Understanding the intricate details of these policies is crucial for making well-informed decisions about green bond investments and their long-term impact on environmental sustainability.

Conclusion: Making an Impact Through Investment

Investing in green bonds is not only beneficial for your portfolio, but it also has a positive impact on the environment and society. As governments, businesses, and individuals become more aware of the importance of sustainability, investments in green bonds will continue to grow. By incorporating green bonds into your investment strategy, you can contribute to a more sustainable future while potentially earning financial returns. With our step-by-step guide, you have all the information you need to start investing in green bonds and make a positive impact for generations to come. So why wait? Join the growing movement towards sustainable finance by incorporating green bonds into your portfolio today!

References

- Climate Bonds Initiative (2021). 2019 Green Bond Market Summary. https://www.climatebonds.net/resources/reports/2019-green-bond-market-summary

- International Finance Corporation (2021). What Are Green Bonds? Retrieved from: https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/green+bonds

- World Bank (2021). Green Bonds Market Summary – 2020. https://treasury.worldbank.org/greenbonds/summary

- European Central Bank (2019). The Role of Government Policies in Promoting Sustainable Finance and Investing. https://www.ecb.europa.eu/pub/conferences/shared/pdf/sustainconference20191024.pdf

- United Nations Environment Programme (2019). Sustainable Investing and Climate Change: World Bank Green Bonds and the Forests Bond. https://www.unepfi.org/fileadmin/documents/sustainable_investment_and_climate_change_world_bank_green_bonds_forests.pdf

- Organization for Economic Co-operation and Development (2020). The Role of Governments in Scaling Up Sustainable Finance. https://www.oecd.org/environment/resources-for-the-future-sustainable-financial-systems-9789264317436-en.htm 7. Investopedia (2021). Green Bond. Retrieved from: https://www.investopedia.com/terms/g/green-bond.asp 8. Forbes (2020). The Growth of Green Bonds and Sustainable Investing. https://www.forbes.com/sites/joemont/2020/08/26/the-growth-of-green-bonds-and-sustainable-investing/?sh=3cfe2a2e30bf 9. Climate Action Tracker (2021). What Are Green Bonds and Why Are They Important? https://climateactiontracker.org/publications/green-bonds/ 10. The Guardian (2019). Green Bonds Were Once a Niche Market – Now They’re Part of the Mainstream. https://www.theguardian.com/business/green-investment-blog/2019/jun/25/green-bonds-were-once-a-niche-market-now-theyre-part-of-the-mainstream 11.

FAQS

How can green bonds help promote sustainability?

Green bonds directly support sustainability by funneling capital towards projects with environmental benefits. These projects often address critical areas such as renewable energy, pollution control, sustainable agriculture, and the conservation of natural resources. By providing a dedicated stream of funding, green bonds incentivize companies and governments to undertake eco-friendly initiatives that might otherwise be sidelined due to budget constraints or competing priorities. Furthermore, green bonds raise awareness about sustainability in the financial markets and encourage investors to consider the environmental impact of their investments.

What are the 4 principles of green bond?

The four main principles of green bond are outlined by the International Capital Market Association (ICMA) as follows:

- Use of Proceeds: The funds raised by green bonds must be allocated to eligible environmental projects.

- Process for Project Evaluation and Selection: Issuers should clearly communicate their environmental sustainability objectives, along with the process for project evaluation, selection, and implementation.

- Management of Proceeds: The net proceeds of the green bond should be tracked, and the information should be transparently reported to stakeholders.

- Reporting: Regular updates on the use of proceeds and the environmental impact of the funded projects must be provided to investors.

What is green bond investment strategy?

A green bond investment strategy involves seeking out fixed-income investments that are designated for financing or refinancing projects with positive environmental and/or climate benefits. Investors who adopt this strategy not only aim for financial returns but also seek to contribute to environmental sustainability. They often integrate ESG (Environmental, Social, Governance) criteria into their investment decisions and may prefer bonds that are certified by third parties to ensure alignment with defined green bond standards.

How do you invest in a sustainable future?

Investing in a sustainable future involves considering ESG factors alongside financial factors in the investment decision-making process. To invest sustainably, individuals can put their money into environmentally friendly companies, green bonds, sustainable mutual funds, and ETFs (exchange-traded funds). They can also choose to engage in shareholder activism to influence corporate behavior or invest in community projects that have a clear positive social or environmental impact.

What are the basics of sustainable investing?

The basics of sustainable investing involve incorporating ESG criteria into investment decisions to manage risk and generate long-term competitive financial returns while also creating a positive societal impact. This entails actively seeking out companies or funds that prioritize sustainability; engage in responsible business practices; and are leaders in environmental stewardship, social responsibility, and governance ethics.

What is the largest sustainable investment strategy?

The largest sustainable investment strategy is commonly considered to be ESG integration, where ESG factors are systematically and explicitly included in financial analysis and investment decisions. ESG integration is followed by a wide margin by other strategies such as socially responsible investing (SRI), impact investing, and active ownership or stewardship. As per the Global Sustainable Investment Alliance (GSIA), assets managed under ESG integration strategies far exceed those of other sustainable approaches.

Read Related Article on Finance:-

Effective Online Investment Techniques for Beginners in Europe

Online investment offers beginners in Europe an excellent opportunity to grow wealth. By grasping investing fundamentals like asset classes and risk management, they can make informed decisions. Choosing the right user-friendly investment platform aligned with their needs is crucial. Leveraging technology tools like investment apps and robo-advisors helps streamline investing activities. Diversifying across industries and regions helps maximize returns while mitigating risks. Staying continuously informed about market trends, economic news, and strategies is key for effective decisions. With the proper knowledge, tools, and strategies, beginners can confidently embark on their investing journey and work towards long-term financial success. There are immense possibilities, so beginners should start understanding basics, choose suitable platforms, diversify wisely, utilize technology, and keep learning………Read More