Table of Contents

Assess Your Skills and Interests for Profitability

Identify activities you engage in that have existing marketplace demand. Common hobby niches like arts & crafts, baked goods, event planning, beauty products, photography, technology skills, creative writing, fitness coaching and more present monetization pathways once honed. Analyze your expertise through a profitability lens – have others requested to buy your creations? Could services around your hobby help people? Establish your income hobby contender upfront in 2024.

Determine the Best Business Structure for Your Side Income

Consider how often you’ll conduct hobby-based commercial transactions, expected earnings, and legal protections needed before selecting between sole proprietorship, LLC, or incorporating your hobby business. Weigh factors like personal liability, separation of business and personal assets, administrative upkeep, legal paperwork, accounting, and taxes when picking the optimal structure for maximizing income.

Structuring appropriately from the start prevents hassles as your hobby income grows. Being organized sets up smooth sailing while avoiding tax hiccups.

Use Tax Strategies to Reduce Your Hobby Income Obligations

Several tactics exist to lower taxes owed on hobby-generated income by offsetting with deductions for legitimate business expenses. Tracking hobby expenditures on equipment, office supplies, internet and mileage establishes deductible expenses that reduce taxable income.

Electing to form an LLC or corporation also provides conduit for additional writeoffs while guarding personal assets. And income thresholds allow bypassing self-employment taxes altogether. Consult knowledgeable tax professionals to capitalize on savings here.

Market Your Offerings Through Multiple Channels

Promoting hobby products or services directly to prospective buyers requires digital visibility and legwork. Building a hobby business website with clear offerings establishes brand identity and discoverability online. Enable ecommerce to easily sell creations globally. Share ongoing content demonstrating your value on social platforms. Offline channels like consigning through local retailers, word-of-mouth via networking groups, and targeting niche demographics through print ads in hobby magazines and at specialty shops will further fuel sales. Use various outlets to gain authority and widen reach.

Provide Excellent Service By Clearly Communicating Value

As hobby income develops from side project into dependable earnings source, provide best-in-class service and support around your offerings. From handling order logistics promptly to resolving issues, convey deep product expertise honestly while avoiding overpromising. Share origin stories bringing meaning to your creations.

Building loyal followers who rave about quality and meaning sets you up for referrals and 5-star reviews that breed ongoing organic growth. When hobby and passion drive business, it shows in memorable positive customer experiences that drive sustainability.

Turning hobbies into tax reduced extra income in 2024 comes from blended passion project and strategic business venture mindset. Align pleasure pastime with profit incentive fueled by tax minimizing framework for happy money making that lasts.

Real-World Hobby Income Success Stories

Get inspired hearing how regular people have profited from hobby businesses just like yours! Some real examples:

- Mary turned her handcrafted jewelry making into a $100k/year Etsy shop now carried in 3 boutique stores after retirement.

- Bob monetized his landscape photography passion into $80k annual income via commissioned fine art prints, licensing images to stock sites, and leading sold out photo tour workshops.

- Jen converted her part-time wedding calligraphy hobby into a full-time LLC that did $250k in sales last year signing lucrative partnerships with 5-star venues.

Tax-Free Hobby Business Ideas

| Hobby | Potential Offerings | Income Possibilities |

|---|---|---|

| Baking | Custom cakes, cookies & desserts | $300+ per special order |

| Arts & Crafts | Handmade jewelry, paintings, ceramics | $100-$5,000+ per piece |

| Photography | Print commissions, workshop events | $50-$150 per print / $2,500+ per workshop |

| Music | Private lessons, studio performances | $50 per hour lesson / $1,500+ per event |

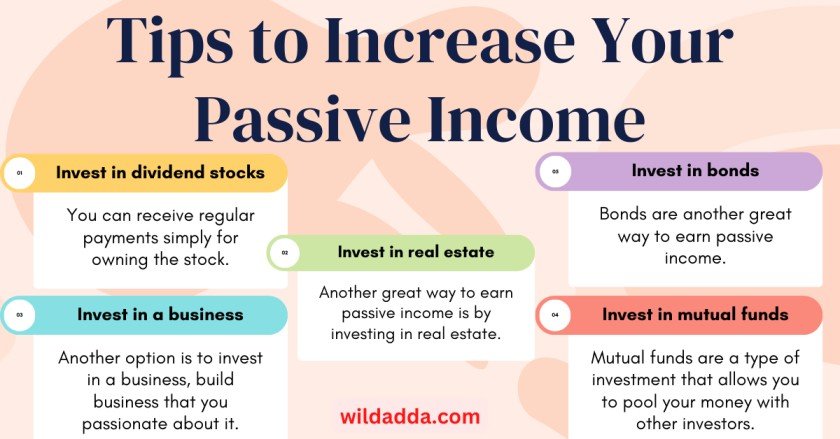

Here are some detailed tips on how to enhance your hobby and boost sales to grow your side income potential:

Level Up Your Hobby Skills

Take classes and courses to expand your knowledge. For photography, that may mean learning new editing techniques. For baking, take a cake decorating masterclass. Read books in your hobby niche and follow top creators for inspiration. Invest in upgraded equipment and software allowing you to offer higher quality offerings. Don’t get stale – continually push your abilities.

Package Offerings Strategically

Bundling products/services together increases perceived value. A baker could offer a wedding cake + macaron tower combo. A jewelry maker can design coordinating bracelet/necklace sets. A musician can provide discounted rates for booking multiple lessons upfront. Think about complementary offerings that appeal to loyal customers.

Create Gift-Worthy Presentations

Luxe packaging elevates hobby products from homemade appearance to premium gift-worthy unboxing experiences. Using ornate containers with tissue paper and seals brings a satisfaction similar to opening a box from a high-end retailer. Make them feel special for supporting your hobby pursuits.

Share the Story Behind Your Business

Get personal connecting your origin story to what you create today. Were you perfecting your recipes through a family cookbook for decades? Did you discover your craft unwinding from corporate stress? Feature these details prominently. Let your brand narrative and the meaning behind it magnetize ideal supporters.

Host Pop-Up Shops at Local Events

Renting a booth at craft fairs, farmer’s markets and local festivals gives opportunity to showcase offerings in front of qualified audiences. Bring plenty of inventory, display professionally with signage and collect buyer info for follow up. Use retail pop-ups to gather feedback and flip passerby interest into sales.

Collaborate with Complimentary Brands

Pursue creative partnerships with local businesses aligning to your hobby offerings. A baker could supply desserts to nearby cafes. Photographer provides prints to area galleries. Musician holds performances at wineries. Cross-promotion and packaged deals turn collaborations into joint growth.

FAQS

- What hobbies can become profitable side hustles?

Monetizable hobbies span cooking/baking, handmade crafts, photography, coaching, writing, programming, consulting, landscaping, reselling thrift store treasures, and more. If your skills bring others joy while solving problems, chances to profit exist with the right business structure.

- How much money can a hobby business make?

Potential earnings vary widely based on niche competition, marketing effort, operations scaling, and pricing models. But many hobby ventures reach $10k+ in annual side income with part-time hours. $20-50k annually comes through offering limited services in high demand. Unique creations fetching prices up to $500+ quickly see 5-figure sales.

- What steps make a hobby legally a business?

Formally making a hobby a legal business involves getting an EIN, registering a business name, establishing a business banking account and address, determining a business structure like sole proprietorship/LLC/corporation, obtaining required licenses/permits, reporting earnings, filing taxes accordingly and complying with regulations.

- How do you minimize hobby income taxes?

Top tax reduction tactics include tracking all legitimate hobby expenses to write off against income, forming an LLC/corporation for additional deductions, strategically managing quarterly estimated payments, harvesting hobby business losses to offset other income, timing income cycle for tax advantage, contributing to retirement accounts like SEP IRA’s, and staying under self-employment tax thresholds through careful planning.

- What should you not turn into a side hustle?

Avoid side hustles in restrictive/regulated industries you lack qualifications for – like finance, healthcare, legal services, childcare etc. Also be cautious of MLMs with oversaturated markets, excessive personal liability risks without proper coverage, and ventures lacking differentiation with commoditized pricing races driving margins down through competition.